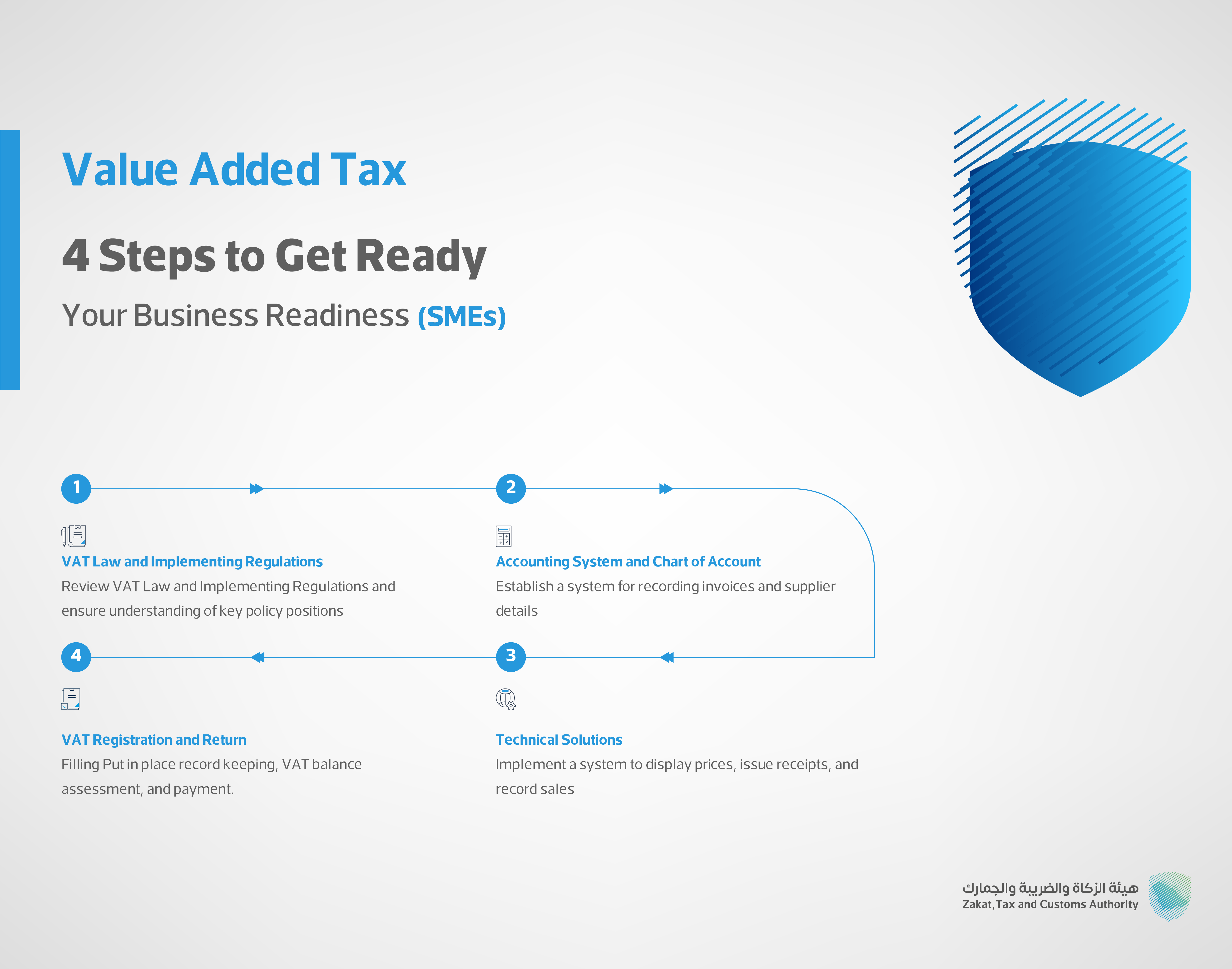

As a representative of a small or medium business, one of your core responsibilities is to ensure the VAT readiness of your organization.

The following four-step guide details all the requirements for VAT readiness. If at any time you require more information or assistant in the VAT readiness process

Further detailing of the readiness steps

VAT

Law and Implementing Regulations

- Develop a detailed

understanding of VAT

- Determine the tax policies

of goods to be sold (5%, zero-rated, or exempt).

- Designate a point of

contact in the company to deal with ZATCAon matters related to VAT

Accounting

system and Chart of Accounts

- Establish a system for

recording and archiving invoices

- Determine the VAT details

of suppliers

Technical

solutions

- Set in place a consistent

means of display for the price of goods (all VAT inclusive)

- Issue sales receipts

compliant with VAT requirements

- Align a system to record

sales with VAT management requirements

- ZATCA has engaged with

a set of PoS and accounting software providers. These solutions will support

SMEs in implementing VAT

VAT

registration and return filing

- Set in place a record

keeping and account practices which address VAT requirements

- Set in place the ability to

assess VAT balance

- Establish the ability to

pay VAT balance

As a small or medium business, you have a variety of ways to find out about your VAT readiness status. The Zakat, Tax and Customs Authority (ZATCA) is committed to supporting you during this process to ensure your businesses are ready.

In addition to direct communications addressed to you (emails, SMS, letters, etc.), the following link