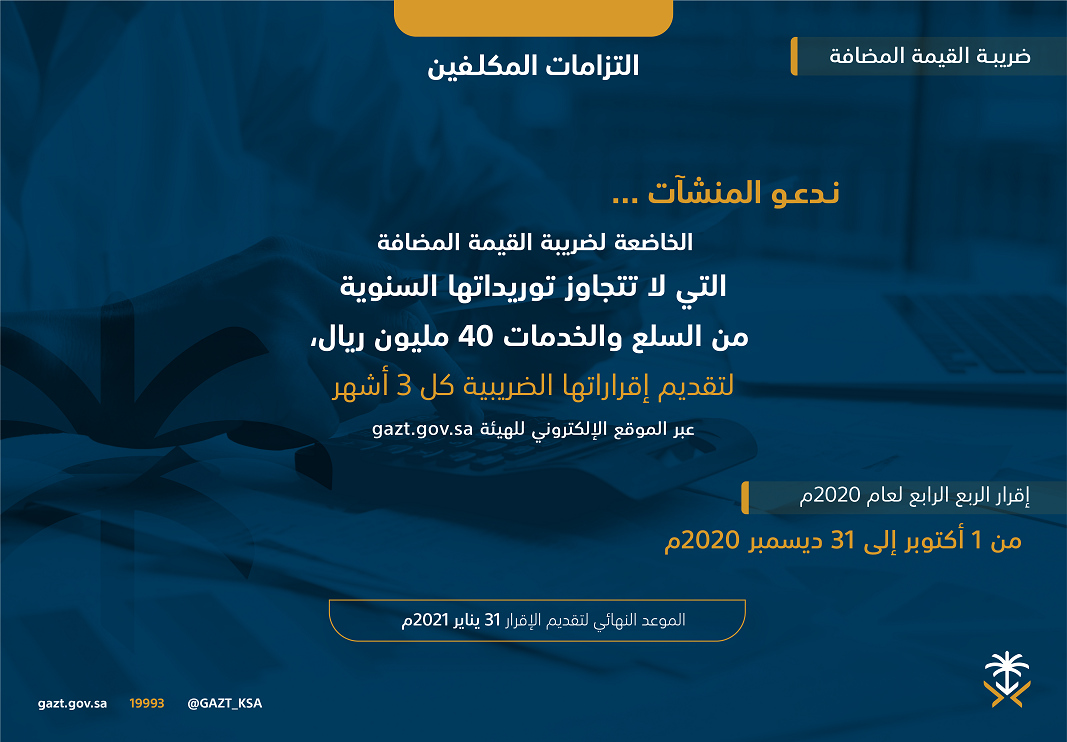

The General Authority of Zakat and Tax (GAZT) has urged persons eligible for VAT to file their tax returns for December and the fourth quarter of 2020, on a date no later than 31st of January.

The Authority has urged taxpayers to submit their tax returns immediately through its website (gazt.gov.sa). A fine shall be imposed on failure to file the tax returns within the specified period. The minimum fine shall be 5% whereas the maximum fine 25% of the value of the tax that must be declared.

In the meantime, GAZT invites taxpayers who wish to learn more about VAT to reach out via its 24/7 call center hotline (19993), the Customer Care Twitter account (@Gazt_care), via e-mail (info@gazt.gov.sa), or by instant messages on GAZT's website (gazt.gov.sa).

VAT is a tax law in force in the Kingdom of Saudi Arabia, as an indirect tax imposed on all goods and services that are bought and sold by businesses, with a few exceptions.